Welcome

News & Articles

EuroCham Executive Board Meeting (EBM)

On 11 August 2025, EuroCham kicked off a new chapter with its first Executive Board Meeting since the June Annual Members Meeting and Extraordinary Members Meeting, chaired by newly elected Chairman, Fabian Kieble. The discussion focused on key priorities — from strengthening membership engagement and deepening collaboration with stakeholders to enhancing advocacy through the working groups for both existing and prospective members. The meeting set a clear direction for major deliverables this year.

A big thank you to all Board Members for their active participation and dedication!

EuroCham X BCGPT Event: Road to UN Plastic Treaty (INC-5.2)

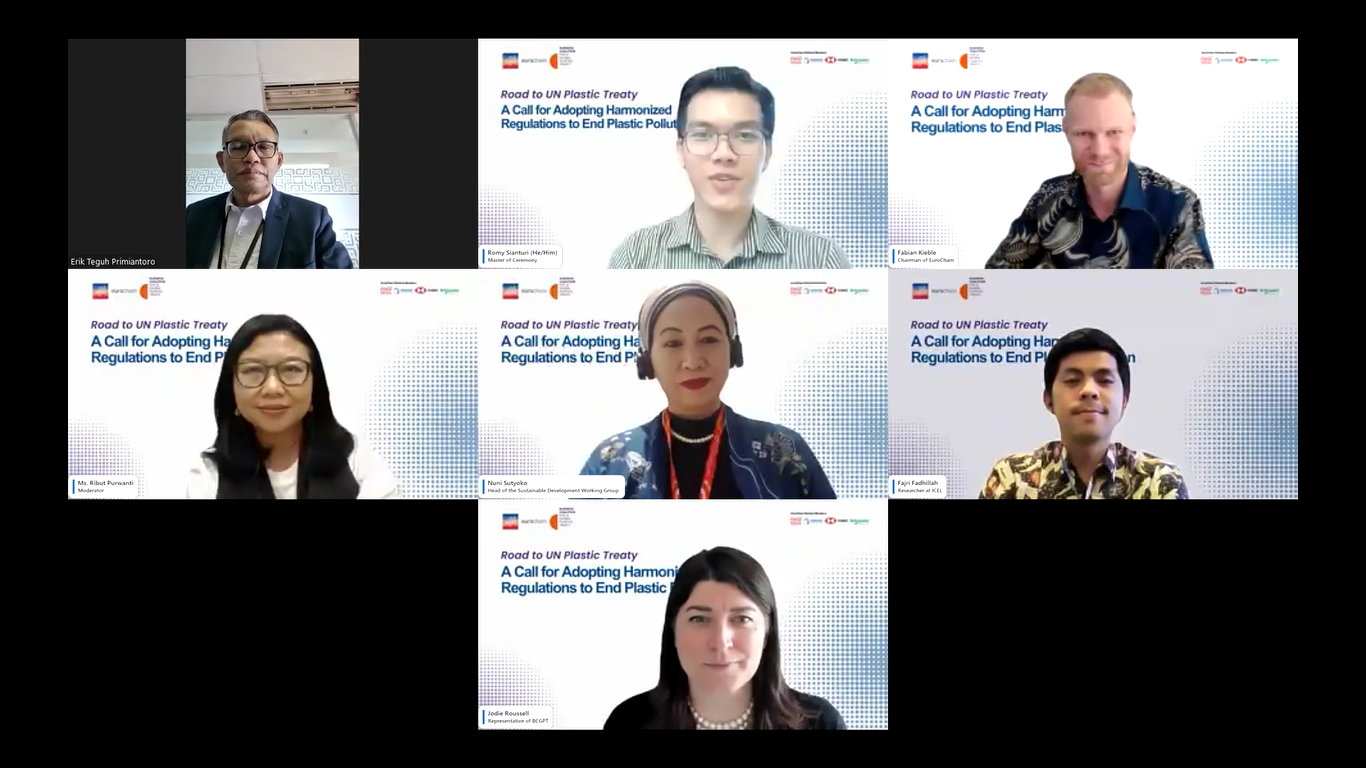

On July 31, EuroCham, in collaboration with the Business Coalition for a Global Plastics Treaty (BCGPT), convened a discussion titled “Road to UN Plastic Treaty: A Call for Adopting Harmonized Regulations to End Plastic Pollution.” The session aimed to highlight regulatory convergence as a crucial enabler in the global fight against plastic pollution, in the lead-up to the upcoming Intergovernmental Negotiating Committee (INC-5.2) meeting.

The event opened with remarks from Fabian Kieble, Chairman of EuroCham and Managing Director of Rhenus Logistics Asia Pacific, and was followed by the keynote from Erik Teguh Priamiantoro, Senior Advisor at the Ministry of Environment and Head of Indonesia Focal Point for INC-5.2. The panel featured insights from Jodie Roussell (BCGPT Representative and Global Public Affairs Lead for Packaging and Sustainability at Nestlé), and Fajri Fadhillah (Head of Pollution and Environmental Damage Control Division, Indonesian Center for Environmental Law), which was moderated by Ribut Purwanti (Deputy of EuroCham Sustainable Development Working Group and Head of External Affairs at Unilever Indonesia).

The discussion concluded with a Q&A session, and closed with the remarks from Nuni Sutyoko (Head of EuroCham’s Sustainable Development Working Group and Head of Corporate Sustainability at HSBC Indonesia).

We would like to thank all the participants for being part of the webinar and for contributing to such an insightful and engaging session